CaptainDan

Member

- Joined

- May 9, 2021

- Messages

- 113

- Reaction Score

- 0

- Points

- 16

- #1

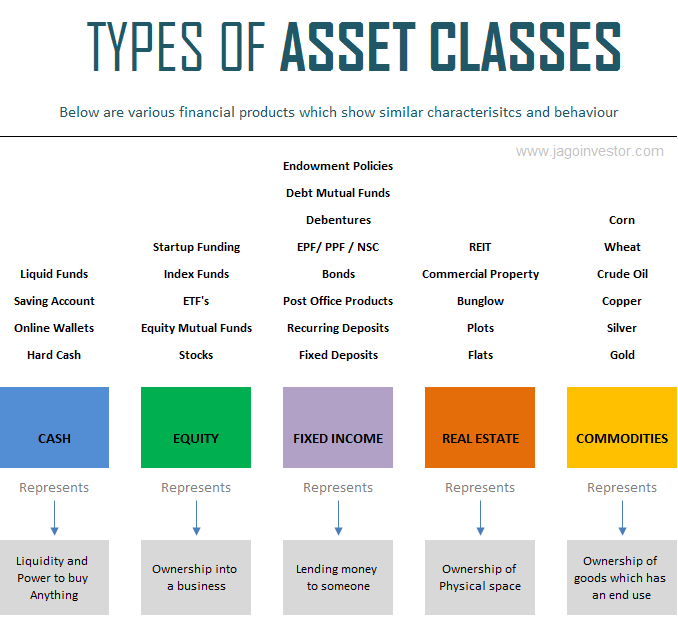

I've been thinking about the definition for asset allocation for a few minutes and came up with the following: it's what you invest in. That's pretty much it. Different types of investments are considered different types of assets. How you allocate those assets is pretty straightforward. For example, let's say you purchase Exxon-Mobile (XOM) stock with 100% of your available funds. Well, you just allocated everything you have to an equity. See? It's easy.

Now, I'm not saying that this type of above investment strategy is a good one. In reality, when finance people talk about asset allocation, they're really referring to what mix of assets an investor holds for reasons such as meeting goals for a specific time-horizon and reducing overall risk. Investors generally try to balance the risk they perceive with their short and long term goals. By placing a portion of their funds in equities, some in fixed income, and keeping some in cash, they reduce the risk of loss while still maintaining some sort of growth. Honestly though, an investor needn't invest across asset classes to have an asset allocation. They can invest all they've got into one stock and still have it.

What Makes Asset Allocation So Important?

For most of my life, I've been listening to people talk about this stock or that. With them, it's always a get rich quick scheme. The best stock pick. As I grew older, I began to realize that while one certainly does need to see a healthy return on investment, they also need to be mindful of how much risk they face in losing what they've invested. I once read that the very wealthy don't chase returns. Their primary goal is to actually avert losses. I found that both interesting and enlightening.

It's long been known among successful investors that choosing the right mix of asset classes is more important than choosing individual securities. It's about how the asset classes play off one another to achieve the risk aversion/reward the investor is after. In general, when investors choose a strategy of asset allocation, they'll also periodically rebalance their portfolios. The two strategies go hand in hand.

What are Some Common Example Asset Allocations?

I've heard about all different types of asset allocations though the years. It's common knowledge that bonds are generally less risky than equities (or more stable in the short term with less volatility), so an investor might want to direct their funds to be invested in both equities (stocks) and bonds. One common asset allocation is the 50/50 stock/bond split, where the investor would place half of their money in stocks and the other half in bonds. A good equity ETF for this would be the Vanguard S&P 500 fund. And a good bond ETF for this would be the Vanguard Total Bond Market fund. I've also heard about an asset allocation rule that many refer to as the "100 Rule." This rule states that an investor should take the number 100 and subtract their age. So if the investor is 45 years old, the result would be 55. That result is the percentage of what the investor should place in equities. For this example, if the investor had $100,000 to place in the market, they'd buy $55,000 of VOO and $45,000 of BND. It's really that simple.

Now, people do all sorts of things when they get into asset allocations. While a stock/bond mix is good, there are also many other asset classes that play well off of each other. As you look more into this type of thing and do your research, you'll find that almost and asset class that's inversely correlated with another can be helpful. For instance, gold is usually inversely correlated with both the U.S. dollar as well as stocks. So if you were attempting to mitigate the risk of stocks, you may want to invest in gold at the same time. Personally, I like to diversify my equity holdings between domestic stocks such as the S&P 500 (VOO), developed market international stocks (VEA), and emerging market stocks (VWO). I also like to have a real estate fund (VNQ) and a healthy portion of bonds (BND). My asset allocation is as follows:

BND - 40%

VNQ - 5%

VOO - 30%

VEA - 20%

VWO - 5%

This mix has been working well for me for years, especially during times of great volatility. Every so often, when these percentages stray from their original values, I'll go ahead and rebalance the funds. I'll be writing posts on both the pros and cons of rebalancing as well how to create your own excel spreadsheet that will handle all of your rebalancing calculations.

If you have any questions regarding asset allocations or if you'd like to share your personal allocation, I'd love to hear what you have to say. Comment down below. Thanks!

Now, I'm not saying that this type of above investment strategy is a good one. In reality, when finance people talk about asset allocation, they're really referring to what mix of assets an investor holds for reasons such as meeting goals for a specific time-horizon and reducing overall risk. Investors generally try to balance the risk they perceive with their short and long term goals. By placing a portion of their funds in equities, some in fixed income, and keeping some in cash, they reduce the risk of loss while still maintaining some sort of growth. Honestly though, an investor needn't invest across asset classes to have an asset allocation. They can invest all they've got into one stock and still have it.

What Makes Asset Allocation So Important?

For most of my life, I've been listening to people talk about this stock or that. With them, it's always a get rich quick scheme. The best stock pick. As I grew older, I began to realize that while one certainly does need to see a healthy return on investment, they also need to be mindful of how much risk they face in losing what they've invested. I once read that the very wealthy don't chase returns. Their primary goal is to actually avert losses. I found that both interesting and enlightening.

It's long been known among successful investors that choosing the right mix of asset classes is more important than choosing individual securities. It's about how the asset classes play off one another to achieve the risk aversion/reward the investor is after. In general, when investors choose a strategy of asset allocation, they'll also periodically rebalance their portfolios. The two strategies go hand in hand.

What are Some Common Example Asset Allocations?

I've heard about all different types of asset allocations though the years. It's common knowledge that bonds are generally less risky than equities (or more stable in the short term with less volatility), so an investor might want to direct their funds to be invested in both equities (stocks) and bonds. One common asset allocation is the 50/50 stock/bond split, where the investor would place half of their money in stocks and the other half in bonds. A good equity ETF for this would be the Vanguard S&P 500 fund. And a good bond ETF for this would be the Vanguard Total Bond Market fund. I've also heard about an asset allocation rule that many refer to as the "100 Rule." This rule states that an investor should take the number 100 and subtract their age. So if the investor is 45 years old, the result would be 55. That result is the percentage of what the investor should place in equities. For this example, if the investor had $100,000 to place in the market, they'd buy $55,000 of VOO and $45,000 of BND. It's really that simple.

Now, people do all sorts of things when they get into asset allocations. While a stock/bond mix is good, there are also many other asset classes that play well off of each other. As you look more into this type of thing and do your research, you'll find that almost and asset class that's inversely correlated with another can be helpful. For instance, gold is usually inversely correlated with both the U.S. dollar as well as stocks. So if you were attempting to mitigate the risk of stocks, you may want to invest in gold at the same time. Personally, I like to diversify my equity holdings between domestic stocks such as the S&P 500 (VOO), developed market international stocks (VEA), and emerging market stocks (VWO). I also like to have a real estate fund (VNQ) and a healthy portion of bonds (BND). My asset allocation is as follows:

BND - 40%

VNQ - 5%

VOO - 30%

VEA - 20%

VWO - 5%

This mix has been working well for me for years, especially during times of great volatility. Every so often, when these percentages stray from their original values, I'll go ahead and rebalance the funds. I'll be writing posts on both the pros and cons of rebalancing as well how to create your own excel spreadsheet that will handle all of your rebalancing calculations.

If you have any questions regarding asset allocations or if you'd like to share your personal allocation, I'd love to hear what you have to say. Comment down below. Thanks!